In July 2022, the United States announced that it would terminate the international treaty signed with Hungary in 1979, that waived the dual income tax payment practice.

Consequences of no US tax treaty?

Although the provisions of the US-Hungary tax exemption treaty were still applicable until the end of last year, the termination of the provision will have a serious impact, expressed in major tax payments, on the activities of affected individuals and companies from this year forward.

The main purpose of double taxation exclusion conventions is to prevent income from being taxed twice by different countries. Where no such convention exists between two countries, only the domestic laws of the countries apply in determining the amount of tax that is levied on certain income, and whether tax paid abroad is taken into account in determining tax liability and, if so, to what extent.

The termination of the US-Hungary tax treaty will likely be painful for Hungarian companies that receive income from the US. This is somewhat tempered by the fact that tax deducted in the United States can, to some extent, be taken into account in determining Hungarian tax liability even in the absence of a treaty. In fact, 90 percent of US source withheld tax can be deducted from Hungarian corporate tax, but the deducted amount cannot exceed the average amount of tax due on the income in question, so that in fact no more than 9 percent of the tax paid abroad can be taken into account.

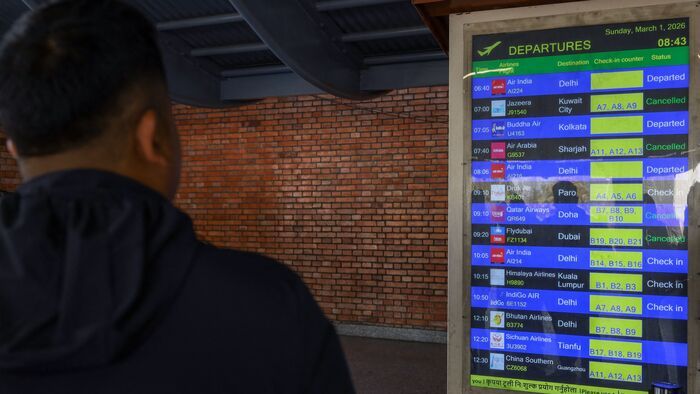

The United States is the largest investor in Hungary outside the European Union, accounting for nearly nine percent of total investments. Bilateral trade in goods increased from 7.1 to 8.3 billion dollars in 2022, an increase of 16 percent, breaking the record for bilateral trade volume, Hungarian Finance Minister Mihaly Varga said after the US-Hungary Business Council (USHBC) meeting last October.

Even though much has transpired between Washington and Budapest since announcement of the agreement termination, it is still an unfriendly move with far-reaching consequences. As part of the autumn tax package, the Hungarian legislature has also reacted to this unfavorable situation in many respects, Economx wrote in December.

Szóljon hozzá!

Jelenleg csak a hozzászólások egy kis részét látja. Hozzászóláshoz és a további kommentek megtekintéséhez lépjen be, vagy regisztráljon!