Many are unaware of how to protect their bank-held money. Many customers only start thinking about financial protection after falling victim to fraud—or in more fortunate cases, after hearing about a scam incident within their circle. Yet, the opportunity for prevention is often already available to customers in their mobile banking apps, as highlighted by financial site BiztosDontes.hu..

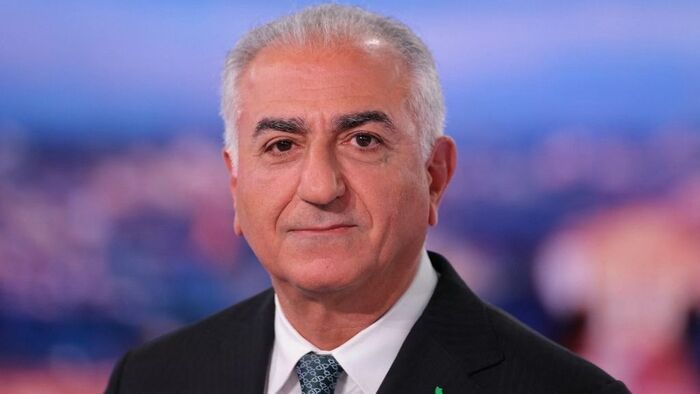

As previously reported, Prime Minister Viktor Orban stated last Friday on Kossuth Radio that the number of phishing crimes and online scams has surged recently. He warned that no one is safe, as scammers are becoming increasingly sophisticated and that more than 8 billion forints (nearly 20 million euros) have already been stolen this year. He added that scammers exploit the goodwill and generosity of Hungarians. While authorities are doing everything they can to recover the hard-earned money, this task is extremely difficult—only 1.5 billion forints (3.7 million euros) have been recovered so far. The prime minister also stated that organized criminal groups are behind the online scams, with 80% of them being Ukrainian.

Available Protective Measures

BiztosDontes notes that daily transfer limits which were introduced at all domestic banks following the recommendation of the Hungarian National Bank (MNB), have received significant media attention. But the portal also cites many other available tools to protect your money.

Identifying Bank Calls via App: This feature is available at Granit and OTP Banks, with more banks expected to follow. These developments help detect scam calls, as the bank’s app will not display fraudulent numbers.

CyberShield Messages: Part of a national effort, these alerts notify users when sensitive account data changes, or when cards are requested, digitized, activated, or blocked. They’re available at all banks via SMS or in-app notifications. Account holders at K&H Bank can manage them, themselves in the bank's app.

Daily Transfer Limits: Can be set in mobile apps of CIB Bank, Erste Bank, Granit Bank, K&H Bank, MagNet Bank and OTP Bank. Other banks offer this opportunity via internet banking, phone and at branches.

Szóljon hozzá!

Jelenleg csak a hozzászólások egy kis részét látja. Hozzászóláshoz és a további kommentek megtekintéséhez lépjen be, vagy regisztráljon!