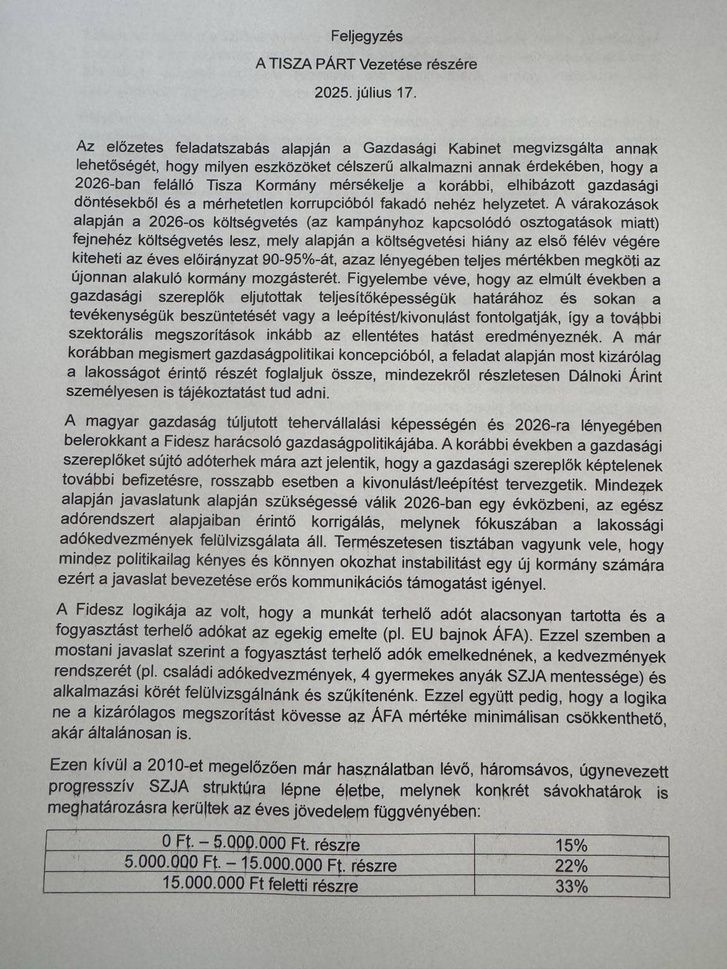

Peter Magyar and his team may be preparing to introduce a three-tier progressive income tax, as revealed by an internal memo prepared for the party leadership that came into the possession of Index. Under the plans of the Tisza Party's economic cabinet, only a very small segment of the population would remain at the current tax level, with even the average wage falling into the 22 percent tax bracket. Above 1.25 million forints, the 33 percent bracket would apply.

All this is being planned by the Tisza Party despite the fact that Peter Magyar had previously promised a significant reduction in personal income tax (PIT).

In the spring, the Tisza Party asked its supporters in a consultation called the Nation's Voice: "Do you agree that personal income tax (PIT) should be reduced to a uniform rate of 9 percent?" The vast majority of the 1.137 million people who completed the questionnaire—more than 900,000 people—understandably voted in favor of the proposed major tax cut.

Promises Are Pretty Words…

At the time, Peter Magyar stated that the consultation’s result would form the backbone of his party’s program in 2026. As Index points out, this would mean that the Tisza Party would introduce a nearly 2,000-billion-forint personal income tax cut, which would blow a huge hole in the budget.

Peter Magyar also promised his supporters a radical VAT reduction. In the Nation's Voice consultation, the abolition of VAT on medicines and the reduction of VAT on "healthy food products" to five percent received overwhelming support, above ninety percent.

Compared to these figures, the plan to reduce personal income tax, which received only 81.9 percent support, can be considered low. Only Ukraine's EU membership (58 percent) received a lower percentage of votes from the Tisza Party's supporters. The reason for this likely lies in the fact that many of the Tisza Party's supporters are committed opponents of the government, who have long been persuaded by left-wing politicians to believe in the fairness and necessity of introducing a multi-bracket tax system.

Szóljon hozzá!

Jelenleg csak a hozzászólások egy kis részét látja. Hozzászóláshoz és a további kommentek megtekintéséhez lépjen be, vagy regisztráljon!