The Tisza Party is preparing the harshest austerity package of the past decades—according to the hundreds-page economic proposal obtained by Index. Based on the document, Peter Magyar’s party clearly intends to initiate a sharply left-wing economic shift, outlining a more radical transformation of Hungary’s tax and contribution system than anything proposed in the past decade.

The document places strong emphasis on social equality and state redistribution, while listing an unusually wide range of tax and contribution increases that would affect the overwhelming majority of Hungarian households and businesses.

The Tisza Party’s program is not a simple reform package but a left-wing economic experiment that would impose tangible burdens on salaries, families, entrepreneurs, and investments alike.

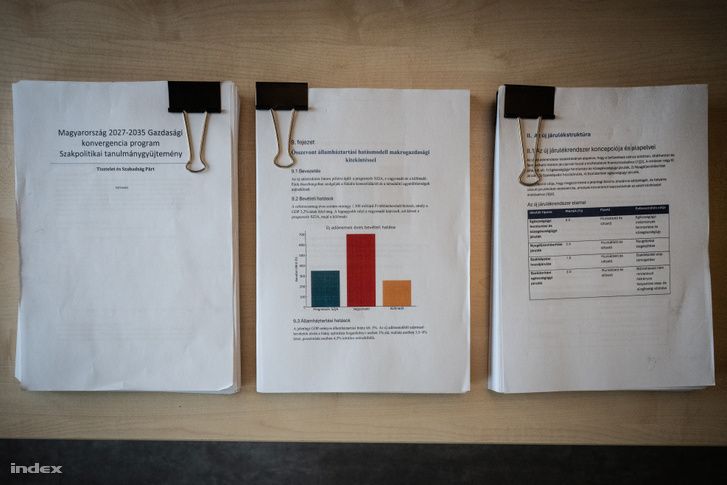

The proposal titled Hungary 2027–2035 Convergence Program is a comprehensive professional dossier. According to Index, the depth and technical detail indicate that the Tisza Party is fully serious about reshaping Hungary’s economic future over the next decade.

While the party’s projected future emphasizes social equality and strengthened social rights, the plan carries the classic risks of left-wing economic policy and could undermine competitiveness.

The program states that the government would need at least 1300 billion additional forints in revenue every year—generated not through economic growth, but through strict austerity measures, higher taxes, and increased social contributions.

Tax Hikes, Elimination of Benefits

The core of the program is a drastic increase in progressive personal income taxation, along with several measures that would fundamentally rewrite the logic of Hungary’s current tax system:

- complete elimination or radical reduction of family and corporate tax reliefs,

- progressive taxation of corporate and capital income, placing new burdens on private and business investments,

- raising VAT to 32 percent—one of the highest in Europe—supplemented by new special taxes on alcohol and tobacco,

- and introduction of a new solidarity-based pension and healthcare contribution system, requiring a full revamp of current payment structures.

The program significantly expands state redistribution and the government's role, while placing much heavier financial burdens on citizens and employers.

Szóljon hozzá!

Jelenleg csak a hozzászólások egy kis részét látja. Hozzászóláshoz és a további kommentek megtekintéséhez lépjen be, vagy regisztráljon!